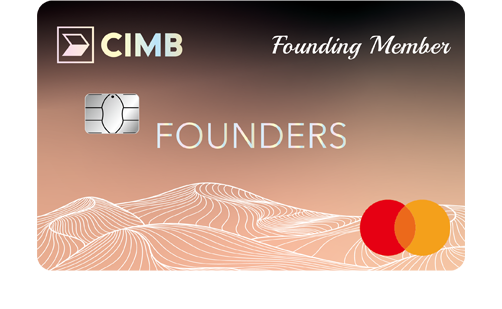

CIMB Singapore has introduced the CIMB Founders Card, the first personal credit card in Singapore specifically designed for entrepreneurs. Created to ease cash flow pressures for sole proprietors and SME owners, the card offers instant access to cash, up to 114 days interest-free on working capital loans, and zero FX fees on overseas transactions, giving business owners greater flexibility to grow and stay resilient.

“For sole proprietors and SME owners, what truly matters is financial flexibility and easy access to capital to support growth. CIMB Singapore is proud to be a partner in their entrepreneurial journey with inclusive and innovative solutions. We are committed to advancing customers and society with services and solutions that drive progress, and the CIMB Founders Card is a meaningful step in that direction.”

Merlyn Tsai, Head of Consumer Banking and Digital at CIMB Singapore.

Addressing SME Financing Challenges

Sole proprietors and SMEs may power almost the entire Singapore economy, making up 99% of all businesses and employing around 70% of the workforce. But access to financing is still a common hurdle. Irregular income streams, limited credit histories or lack of collateral often get in the way.

Most personal credit cards are designed with consumers in mind, rewarding lifestyle spending with cashback or travel perks. For business owners who constantly balance both personal and business financial needs, these cards rarely hit the mark.

That’s where the new CIMB Founders Card steps in. Rolled out in line with the government’s call for more SME-friendly financial solutions, it offers a practical way for entrepreneurs to better manage cash flow and seize growth opportunities.

Key Features of the CIMB Founders Card

Entrepreneurs can look forward to a suite of benefits designed to improve cashflow, reduce costs and support business growth.

| Feature | Details |

|---|---|

| Instant Cash Access | Withdraw from available credit limit via CIMB Clicks mobile app |

| Zero Interest Period | Up to 114 days on working capital loan (1% processing fee, EIR up to 4.47% p.a.) and up to 113 days on retail purchases |

| Zero FX Fees | No foreign currency or admin fees for overseas spend |

| Inclusive Eligibility | Minimum qualifying income of S$30,000 (sole proprietor, self-employed, business owner, contractor) |

| Travel Benefits | Complimentary access to 1,300+ airport lounges worldwide via Mastercard Travel Pass, travel insurance up to S$1 million |

| Business Perks | Mastercard Easy Savings Specials, discounted co-working spaces, productivity software savings |

| Launch Gift | Nespresso Essenza Mini (worth S$209) with new applications, while stocks last |

Empowering SMEs Beyond Banking

Merlyn Tsai, Head of Consumer Banking and Digital at CIMB Singapore, highlighted that financial flexibility and access to capital are crucial for entrepreneurs. The bank aims to support business owners in their growth journey with inclusive and innovative solutions.

To further spotlight local SMEs, CIMB will also be running a campaign that offers complimentary bus stop advertising opportunities for selected businesses.

Partnering with Mastercard, the card extends additional privileges, reinforcing a shared commitment to ensuring that small businesses have access to the solutions they need to thrive.