Foreign visitors entering Singapore can now buy inbound travel insurance coverage for Covid-19 related costs incurred in Singapore. AIG Asia Pacific Insurance Pte Ltd, Chubb Insurance Singapore Limited and HL Assurance Pte Ltd have developed insurance products which provide at least S$30,000 in coverage for Covid-19 related medical treatment and hospitalisation costs, as recommended by the Ministry of Healthy based on Covid-19 bill sizes at private hospitals. This insurance does not cover the cost of Covid-19 PCR test upon arrival in Singapore.

This initiative by Changi Airport Group and The Singapore Tourism Board and the Emerging Stronger Taskforce Alliance for Action on Enabling Safe and Innovative Visitor Experiences have worked with General Insurance Association of Singapore to reach out to private sector insurers to provide such coverage as the nation opens up to more inbound visitors.

Inbound foreign travellers entering Singapore via the Safe Travel Lanes are required to bear the full cost of medical treatment, tests and isolation, should they be suspected of being infected with Covid-19, or require medical treatment for Covid-19 while in Singapore. Information about post-arrival Stay-Home Notice and Swab is available here.

Premiums for these insurance plans have been kept relatively low and affordable starting from S$5.35 inclusive of GST.

| AIG Asia Pacific Insurance Pte Ltd | Singapore Travel Assist | S$250,000 | Available now |

| Chubb Insurance Singapore Limited | SG Travel Insured (Bronze, Silver, Gold, Platinum) | S$30,000 S$50,000 S$175,000 S$250,000 | Available from 27 November 2020 |

| HL Assurance Pte Ltd | ChangiAssure Covid Insurance (Basic+ or Superior) | S$30,000 S$100,000 | Available now |

Inbound Travel Insurance with Covid-19 Coverage

AIG – Singapore Travel Assist

| Section | Benefits | Sum insured up to: |

|---|---|---|

| A1 | Emergency Medical Expenses – if you test positive for Covid-19 | S$250,000 |

| A2 | Repatriation of Mortal Remains in the event of death from COVID-19 | S$150,000 (Sub-limit of A1) |

| B | Emergency Travel Assistance | Included |

Coverage starts when you arrive in Singapore as shown on the certificate of insurance and ends at the earlier of the time of departure from Singapore or 90 days after this cover started. AIG will settle claims directly with the medical services provider and not the insured person.

It is important to contact the 24 hour emergency service Assistance Company at +6564193075 or email SGAssistance@aig.com to notify AIG of a claim with supporting Claim documents submitted as soon as reasonably possible from the date of the event happening.

The policy wording for AIG’s Singapore Travel Assist can be found here.

Chubb Insurance – SG Travel Insured

SG Travel Insured will only be available from 27 November 2020. There are four plan types with different levels of coverage to choose from and affordable premiums from as low as S$19.15.

It covers the following Covid-19 Related Benefits:

- Hospital and Medical Expenses

- 24-hour Assistance Hotline

- Repatriation of Mortal Remains (Optional Add On)

- Trip Cancellation (Optional Add On)

- Trip Curtailment (Optional Add On)

- Hospital Cash (Optional Add On)

| Policy Benefits | Bronze | Silver | Gold | Platinum |

|---|---|---|---|---|

| Hospitalisation and Medical Expenses (Inpatient only) Covers medical expenses due to hospitalisation* for COVID-19 treatment in Singapore. Post journey medical expenses and non-COVID-19 related treatments are excluded. *Excludes community establishments, health hydro or nature cure clinic, a clinic, nursing, rest, rehabilitative, convalescent home, extended-care facility or similar establishment. | Up to S$30,000 | Up to S$50,000 | Up to S$175,000 | Up to S$250,000 |

| Benefits | Bronze | Silver | Gold | Platinum |

|---|---|---|---|---|

| Repatriation of Mortal Remains Covers repatriation of mortal remains for death due to COVID-19. | Up to S$80,000 | Up to S$80,000 | Up to S$150,000 | Up to S$150,000 |

| Journey Cancellation Covers non-refundable flight or accommodation expenses if you/your travel companion is diagnosed with COVID-19 within 15 days before your scheduled trip departure date. | Up to S$2,000 | Up to S$2,000 | Up to S$2,000 | Up to S$2,000 |

| Journey Curtailment Covers non-refundable trip costs and additional travel expenses to return to your country of residence if you/your travel companion is diagnosed with COVID-19 while in Singapore. | Up to S$1,000 | Up to S$1,000 | Up to S$1,000 | Up to S$1,000 |

| Hospital Confinement Benefit Payout of hospital cash upon hospitalisation treatment required by doctor upon diagnosis of COVID-19 in Singapore. 2 days deductible applies. | S$100 per day up to maximum of 14 days | S$100 per day up to maximum of 14 days | S$100 per day up to maximum of 14 days | S$100 per day up to maximum of 14 days |

You can purchase SG Travel Insured online at Chubb’s website. Full policy wording here.

HL Assurance – ChangiAssure Covid Insurance

ChangiAssure Covid Insurance is underwritten by HL Assurance and distributed by Changi Travel Services Pte Ltd. The insurance can be purchased on Changi Recommends website prior to arrival, as long as you are between 3 to 70 years old arriving in Singapore via the Fast Lane regions of the People’s Republic of China, Malaysia, Brunei, South Korea and New Zealand.

Should there be a need to claim, you can do that at Changi Recommends counters at Changi Airport and get instant claims of up to S$2,500. Insurance premium starts from S$37.50 for the Basic Plan, from S$58.85 for Basic+ and S$98.75 for Superior. The maximum period of insurance is up to 14 days.

| Coverage | Basic | Basic+ | Superior |

|---|---|---|---|

| Covid-19 Hospitalisation and Quarantine Facility Expenses in Singapore | S$8,000 | S$30,000 | S$100,000 |

| Non Covid-19 Accidental Hospitalisation Expenses in Singapore for individual age 3 to 70 years. | – | – | S$100,000 |

| Accidental Death and Disability in Singapore for individual age 3 to 70 years | – | – | S$200,000 |

| Loss of Baggage and Personal Effects | – | – | S$500 |

| Personal Money | – | – | S$500 |

| Personal Documents | – | – | S$500 |

| Baggage Delay in Singapore | – | – | S$500 |

| Trip Curtailment | – | – | S$500 |

| Travel Delay in Singapore | – | – | S$500 |

| Flight Overbooked in Singapore | – | – | S$500 |

| Repatriation of Mortal Remains | – | – | S$10,000 |

When tested positive for Covid-19 upon arrival in Singapore, you will need to notify the appointed assistance company in writing or call +65 6922 6009 to operations@emgalobal.com.my within 48 hours of receiving the positive Covid-19 PCR test results and submit the test results and admission diagnosis obtained from laboratories approved by the Ministry of Health, policy schedule and travel documents including SafeTravel Pass or Air Travel Pass approval letter as well as supporting evidence as proof of compliance with the terms and conditions imposed by the Authorities. Submission has to be at least 5 working days prior to departure from Singapore.

Click here for the terms and conditions of the insurance cover.

Outbound Travel Insurance with Covid-19 Coverage

With the opening up of travel to Hong Kong from 22 November 2020, what kind of Covid-19 insurance coverage can leisure travellers purchase?

On 26 November 2020, NTUC Income is the first direct insurer to include Covid-19 coverage under its single-trip Travel Insurance. Airlines such as Emirates, Etihad or Scoot have partnered insurers to cover Covid-19 for its customers travelling to other destinations.

NTUC Income Single Trip Travel Insurance Plans

On 26 November 2020, NTUC Income launched its Single Trip Travel Insurance Plans with Covid-19 coverage for medical-related expenses while overseas.

This enhancement will protect travellers who purchase Income’s single trip travel insurance for 90 days for COVID-19 related hospitalisation expenses of up to US$100,000 while overseas. There is also cover for costs incurred for medical evacuation or repatriation of up to US$100,000 when it is needed.

| Benefits | Limit per insured person | Limit per family (subject to limit per insured person) |

|---|---|---|

| Medical expenses overseas due to Covid-19 | US$100,000 | US$300,000 |

| Emergency medical evacuation due to Covid-19 | US$100.000 | US$300,000 |

| Sending you home due to Covid-19 | US$100.000 | US$300,000 |

However, these COVID-19 benefits will be excluded from travel insurance for trips to countries that the World Health Organisation deems as high-risk for COVID at the point of purchase.

Policyholders with existing annual travel insurance plans from INCOME should contact Income by calling +656788 1222 or contact your income advisor to find out about getting covered for upcoming travel. Provide INCOME with your policy number and trip details separately to get a quote to include Covid-19 Coverage for each upcoming trip.

| If you have purchased your policy/included the COVID-19 Coverage in your policy: | The following COVID-19 high risk countries are excluded countries: |

| From 26 Nov 2020 to 25 Dec 2020 | Albania, Andorra, Argentina, Armenia, Austria, Belgium, Belize, Bosnia and Herzegovina, Bulgaria, Colombia, Costa Rica, Croatia, Curaçao, Czechia, Denmark, France, French Polynesia, Georgia, Germany, Gibraltar, Greece, Guam, Hungary, Italy, Jordan, Kosovo, Kuwait, Latvia, Lebanon, Liechtenstein, Lithuania, Luxembourg, Malta, Martinique, Mayotte, Monaco, Montenegro, Netherlands, North Macedonia, Panama, Poland, Portugal, Puerto Rico, Republic of Moldova, Romania, Russian Federation, Saint Barthélemy, Saint Martin, San Marino, Serbia, Sint Maarten, Slovakia, Slovenia, Spain, Sweden, Switzerland, The United Kingdom, Ukraine, United States of America |

AXA SmartTravel

AXA Insurance’s travel insurance AXA SmartTraveller has been enhanced to include COVID-19 cover starting from 1 December 2020. Both existing and new AXA SmartTraveller customers will be covered by benefits related to COVID-19 including medical expenses, hospitalisation allowance and quarantine allowance while overseas as well as emergency medical evacuation and repatriation, pre-departure trip cancellations and postponement, and trip curtailment or rearrangement losses.

AXA offers two plans – The Essential and Comprehensive plans with different coverage limits for the same range of benefits.

| Benefit | Essential Plan Coverage Limit | Comprehensive Plan Coverage Limit | |

|---|---|---|---|

| 1 | Overseas Medical Expenses | Up to S$50,000 per person | Up to S$100,000 per person |

| 2 | Overseas Hospitalisation Allowance | S$100 per day, up to S$1,000 | S$100 per day, up to S$2,000 |

| 3 | Overseas Quarantine Allowance | S$50 per day, up to S$350 | S$50 per day, up to S$700 |

| 4 | Emergency Medical Evacuation and Repatriation | Full cover | Full cover |

| 5 | (a) Trip Cancellation (b) Trip Postponement | (a) S$1,000 (b) S$500 | (a) S$2,000 (b) S$1,000 |

| 6 | Trip Curtailment or Rearrangement | S$2,000 | S$4,000 |

You will be covered under these scenarios:

- Fails temperature screening at departure gate at the airport and has to cancel the trip. Certified to be infected with COVID-19 subsequently.

- Tests positive for COVID-19 and requires hospitalisation during the trip

- Forced to be quarantined due to COVID-19 infection whilst overseas

- Forced to cancel trip as the sole travelling companion tested positive for COVID-19

- Has to rearrange itinerary whist overseas as there are no flights due to COVID-19

You WILL NOT be covered under this circumstance:

- Cancels the trip in compliance with Singapore government advisory against travel to the specific destination

- If the general entry requirement for all inbound visitors is to self-isolate/quarantine for 14 days upon arrival in the country, quarantine allowance is not covered

- Cost of Polymerase Chain Reaction test (or swab test) if the result is negative

- Cruise holidays

- One-way trips

You can purchase AXA SmartTraveller here.

Singapore Airlines – AIG Travel Guard

Singapore residents travelling on Singapore Airlines from Singapore to Hong Kong can pay for travel insurance by Travel Guard that is underwritten by AIG exclusively for the airline. Premiums start from S$34.

Since 17 August 2020, coverage due to Covid-19 for return trips include up to S$350,000 for overseas medical expenses and emergency evacuation, up to S$7,000 travel cancellation and postponement and up to S$150 daily cash allowance for quarantine at destination, capped at 14 consecutive days.

| International | Asia | Asean | |

| Quarantine Allowance Per Day for up to 14 consecutive days when overseas. This benefit does not apply for mandatory Quarantine measures for all arriving passengers or Quarantine mandates. | S$100 | S$100 | S$50 |

| Benefit | Covered Conditions and Exclusions |

|---|---|

| Medical Expenses Incurred Overseas & Emergency Medical Evacuation & Repatriation | If you are diagnosed with COVID-19 whilst overseas, AIG will pay up to S$350,000 for the necessary and reasonable medical costs incurred during your trip. Included within the Medical Expenses Incurred Overseas benefit limit of S$350,000 above, if you contract COVID-19 during Your Trip, AIG will cover the cost of emergency evacuation if deemed medically necessary. This benefit includes the cost of returning your body or ashes to Singapore up to the limit stated in the Policy. |

For one-way trips, only travel cancellation and postponement benefits are available.

What IS NOT covered under the policy under any circumstance and regardless of whether it is a return or one way trip:

- Travel Cancellation due to disinclination to travel, change of mind, or fear of travel due to COVID-19.

- Travel Cancellation or Travel Interruption due to epidemic/pandemic-related advisories issued by governments, health authorities or the World Health Organization, by or for destination country or origin country, advising against non-essential travel.

- Travel Cancellation, Travel Interruption or Travel Curtailment resulting from border closures, Quarantine or other government directives.

- Travel Cancellation if an airline, hotel, travel agent or any provider of travel and/or accommodation has offered a voucher or credit for cancellation refund.

- Quarantine that is mandatory for all arriving passengers or a Quarantine mandate that exists for passengers from a particular country / region of origin.

- Travel Interruption for any costs incurred for Quarantine after you return to Singapore.

You can check the full terms and conditions of Travel Guard insurance here.

Purchasing Travel Guard from the Singapore Airlines website also offers some Krisflyer member exclusive coverage including hospital income in Singapore, fraudulent credit card usage, additional accidental death and permanent disablement benefit, treatment by physician and coverage for kidnap, hostage and hijack of public conveyance.

As part of AXA’s continued commitment to support our customers during this time, we are looking to include COVID-19 cover into more of our offerings so that such coverage is available to everyone, regardless of the airline they are flying with. We want to provide greater assurance to travellers, particularly those who are allowed to travel overseas under permitted arrangements.

Julien Callard, Managing Director, Retail & Health, AXA Insurance:

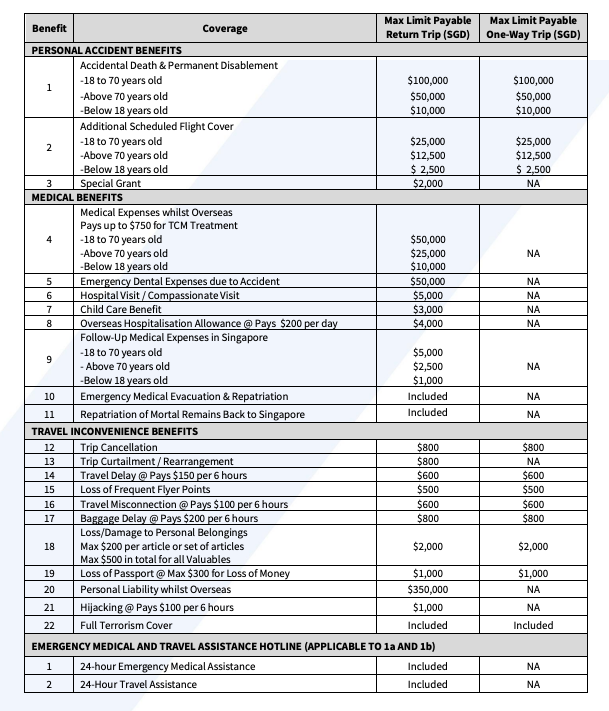

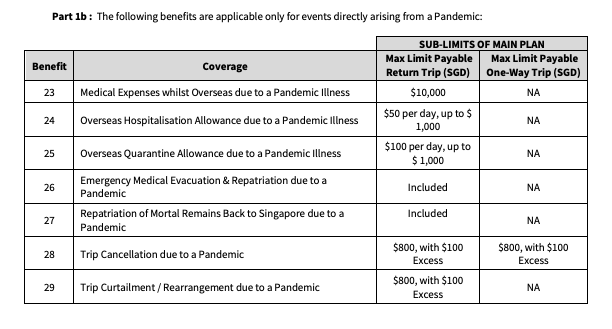

AXA – Scootsurance

Since 10 September 2020, Scoot has partnered AXA to offer Covid-19 coverage for Scoot Passengers who purchased Scootsurance with flights departing Singapore. Key features of the insurance include 24 hour emergency medical assistance hotline, terrorism cover, trip cancellation including due to Covid-19 infection, loss and damage of personal belongings whilst overseas and travel & baggage delay. The policy also covers additional scheduled flight cover and loss of frequent flyer points when flying on a Scoot or Scoot affiliated flight.

AXA Scootsurance covers up to S$10,000 for medical expenses whilst overseas due to a Pandemic illness as well as other benefits such as overseas hospitalisation allowance of S$50 per day up to S$1,000 and a S$100 per day allowance for up to S$1,000 for overseas quarantine.

Should a Scootsurance policyholder test positive for Covid-19 prior to departure in Singapore, claims for reimbursement of non-refundable airfare and accommodation under the trip cancellation benefit up to the benefit limit are allowed. And if the policyholder tests positive for Covid-19 upon arrival in the airport overseas, he or she will be covered for overseas medical expenses incurred due to Covid-19 diagnosis as well as overseas hospitalisation allowance.

How to get a Covid-19 PCR Test in Singapore?

From 30 November 2020 11.59 pm, any company or individual who requires a Covid-19 Polymerase Chain Reaction (PCR) test will be able to procure such services from some 600 approved clinics and providers. This includes individuals who require pre-departure testing and they will no longer be required to seek approval from Ministry of Health for pre-departure tests.

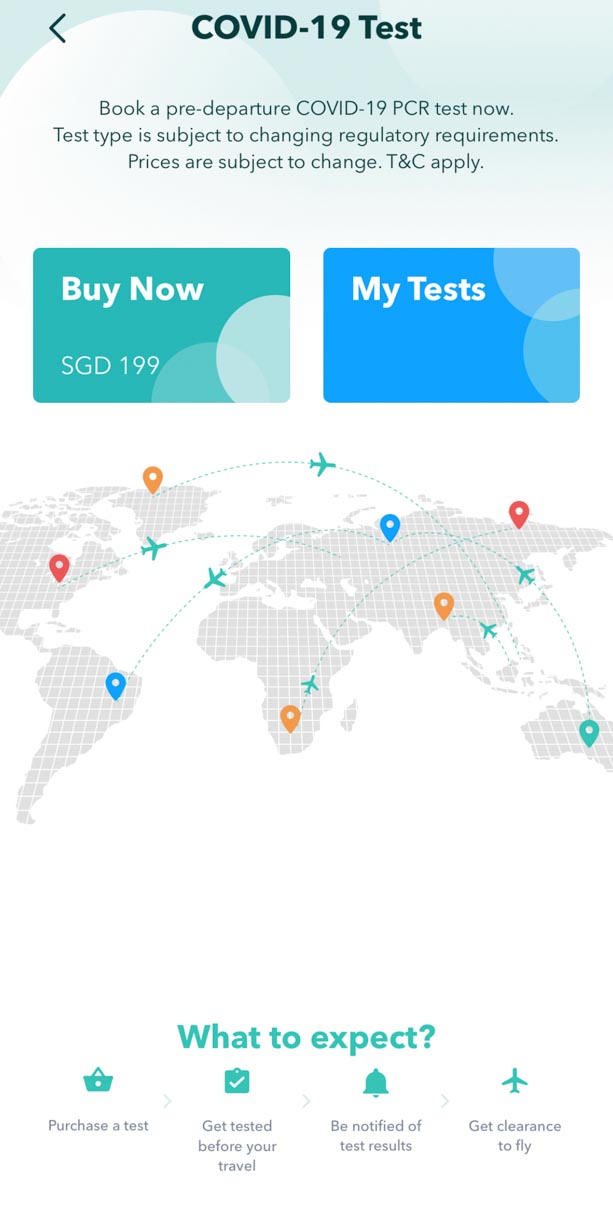

You can also download the Raffles Connect mobile app by Raffles Medical Group and book a Covid-19 Test through the app. The test will cost you S$199.

This service is currently available primarily to outbound travellers from Singapore, and at RafflesMedical clinics in three locations in Hong Kong – Hong Kong International Airport Clinic, Central and Tsim Sha Tsui. As more reciprocal travel arrangements are established, the Group has the capability to scale this offering to other cities and cater for more travellers. RMG will be proactively ramping up testing capabilities and optimising operations in relation to the ATB ahead of the first passenger flight to Hong Kong on 22 November as well as in preparation to cater for the demand for voluntary testing from 1 December.

Travellers simply have to follow the following steps:

- Register or sign-in to the Raffles Connect app.

- Click on the “COVID-19 Test” category in the main app interface.

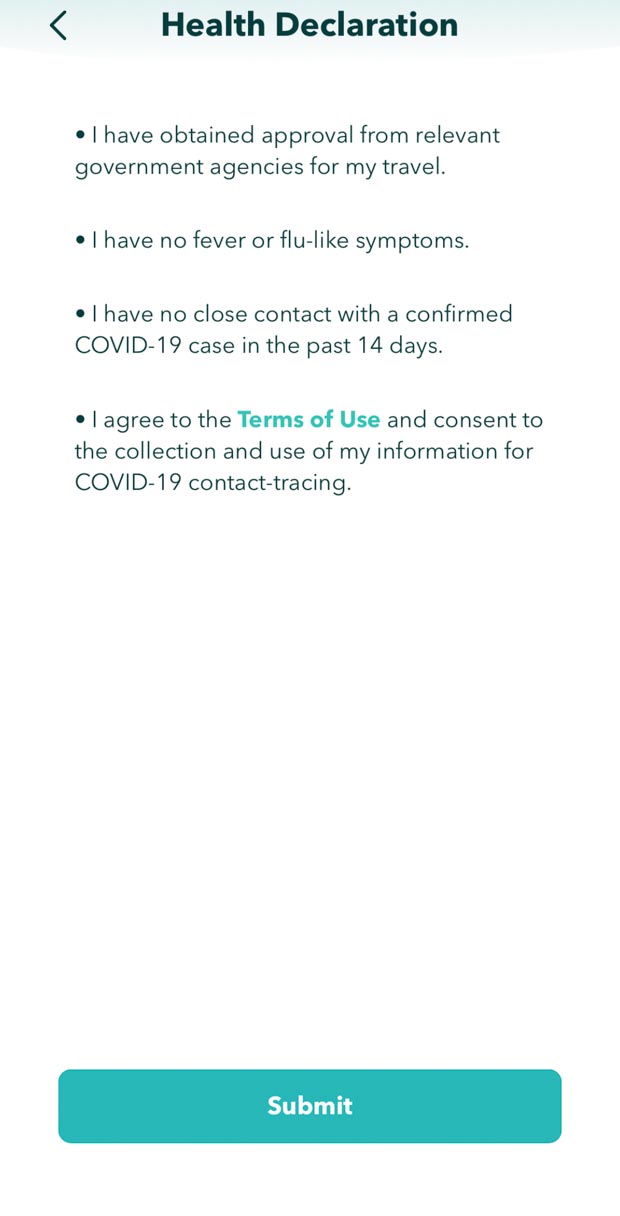

- Click on the “Buy Now” purchase button for COVID-19 PCR test and submit a Health Declaration Form.

- Select a Raffles Medical clinic of choice and an appointment slot will be offered to you closest to your departure date.

- Submit flight details of the travel itinerary.

- Choose a mode of payment in-app.

- Receive reminders of the appointment through the app and within 24-36 hours of administration the test, receive test results in-app and from the clinic.

Resumption of Government subsidies and MediShield Life, Insurance Plans and Private Insurance for Covid-19 treatment

Singapore citizens, permanent residents, long-term passholders who travel out of Singapore from 27 March 2020 onwards were responsible for their own inpatient medical bills if they have onset of symptoms for Covid-19 within 14 days of their return to Singapore. They were not able to utilise government subsidies or insurance coverage from MediShield Life, Integrated Plans or private insurance.

Since 20 October 2020, in line with the progressive move to reopen Singapore borders, Singapore residents will henceforth be allowed to access government subsidies and insurance coverage for their medical bills.

Pingback: AXS earmarks millions in partnership with HL Assurance to enhance cyber fraud protection for users | SUPERADRIANME.com

Pingback: Updates on Singapore Border Measures and travel Insurance »

Pingback: NTUC Income Includes Coverage for COVID-19 for Overseas Travel »