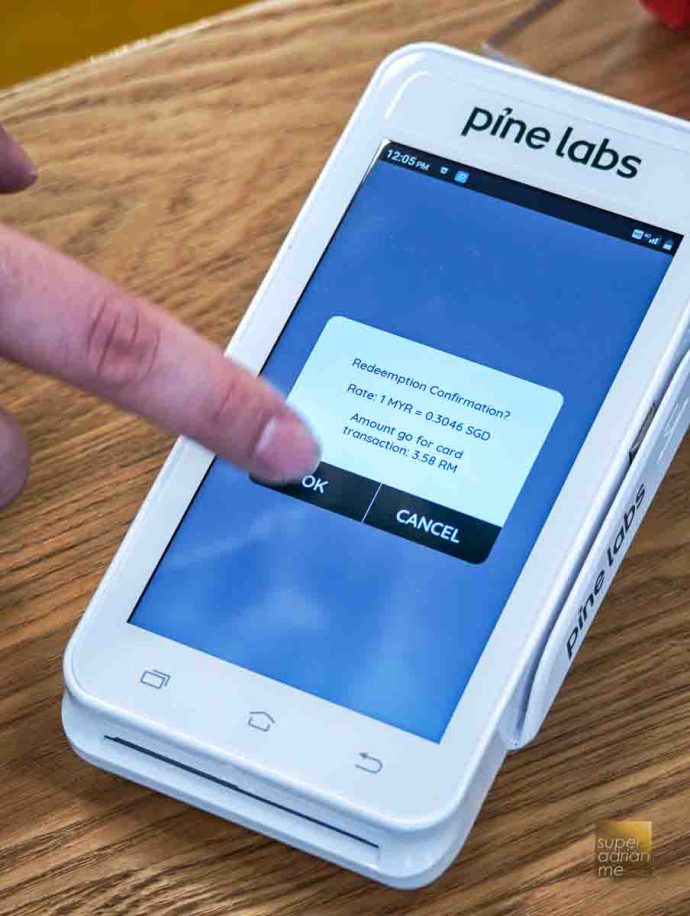

UOB’s Singapore credit card customers can now redeem their UNI$ rewards points to offset their bills at over 150 merchant outlets at the point of sale. in Johor, Malaysia. Read on to find out about the other cardholder benefits in Johor.

Bring along an eligible physical Singapore-issued UOB Mastercard or Visa Credit Card (UOB Lady’s Card, PRVI Miles Credit Card, UOB Visa Signature Credit Card, etc) to Johor Bahru and redeem UNI$ rewards (UNI$500=S$5 or equivalent in Malaysian Ringgit) at over 150 merchant outlets across Johor, such as Courts, Jean Yip, MI, Ogawa, Switch, UR and more.

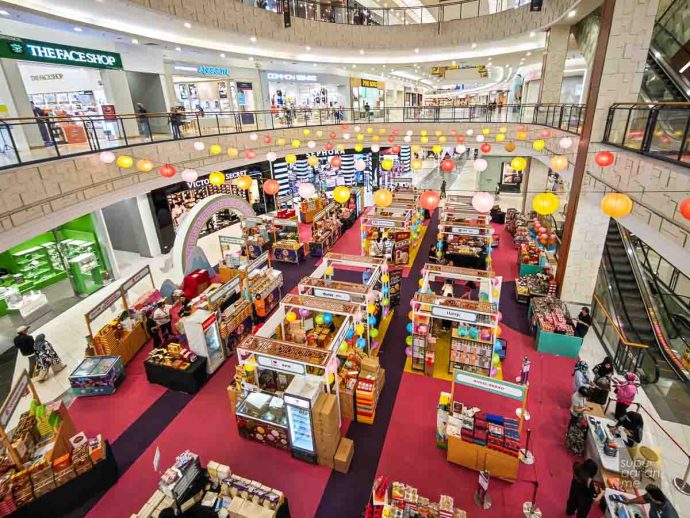

At AEON Mall in JB, UOB cardholders currently enjoy special deals for Mid-Autumn (spend at least RM200 on mooncake purchases or take the AEON MALL Shopping Tour Bus and present your UOB card to receive RM20 AEON Mall vouchers) and Christmas in November and December. Diners at participating restaurants in AEON Malls get complimentary delights. Based on the bank’s customer spend data, Hai Di Lao and Din Tai Fung are in the top 10 restaurant spend in Johor in first half of 2025.

Other exclusive offers launched include usage offers and discounts with popular F&B outlets such as Din Tai Fung, Oriental Kopi, Haidilao and others, RM5 discounts for Grab rides within Johor and 25% off hotel bookings via Unravel in Johor.

This cross-border redemption feature caters to rising cross-border consumer traffic and spending in Malaysia, where Singapore visitor numbers have grown by over 22% in the first half of 2025, compared to the same period last year. The strengthening economic links and increased connectivity between the two cities, together with the newly created Johor-Singapore Special Economic Zone and the upcoming Singapore Rapid Transit System in 2026, are expected to drive continued growth.

Spending by Singapore UOB credit card customers in Malaysia has been climbing steadily, with billings rising around 40% each year between 2022 and 2024, followed by a further 20% year-on-year increase in the first half of 2025. Johor recorded the strongest growth at 60% annually over the same period, accounting for nearly half of all card spending in Malaysia during the first six months of 2025.

UOB already provides a suite of cross-border solutions, including travel-focused cards like the UOB PRVI Miles Credit Card, the EVOL Card with 0% foreign exchange fees, and the multi-currency FX+ Debit Card. Enhancements have been made to the EVOL Credit Card and FX+ Debit Card, which now give customers additional cashback of 10% and 3% respectively, on top of the existing 0% FX fees. Customers can also make payments via Duitnow QR and enjoy fee-free overseas withdrawals at UOB’s 32 ATMs in Johor.

“Singaporeans love travelling to Johor. In the first half of 2025, Sngapore UOB cardholders spent nearly 15% more overseas compared to the same period in 2024, higher than the regional average. Of this, they are spending 20% more in Malaysia, with half of that spend in Johor. Leveraging the Bank’s strong presence in Malaysia, our new rewards capability opens a fresh avenue for our customers to stretch their rewards and experience greater value deals as they cross the border. This marks the next phase of our goal to create a borderless rewards ecosystem, providing our ASEAN customers with more choices, enhanced flexibility and greater value in how they spend, earn and redeem rewards overseas.”

Ms Jacquelyn Tan, Head of Group Personal Financial Services, UOB