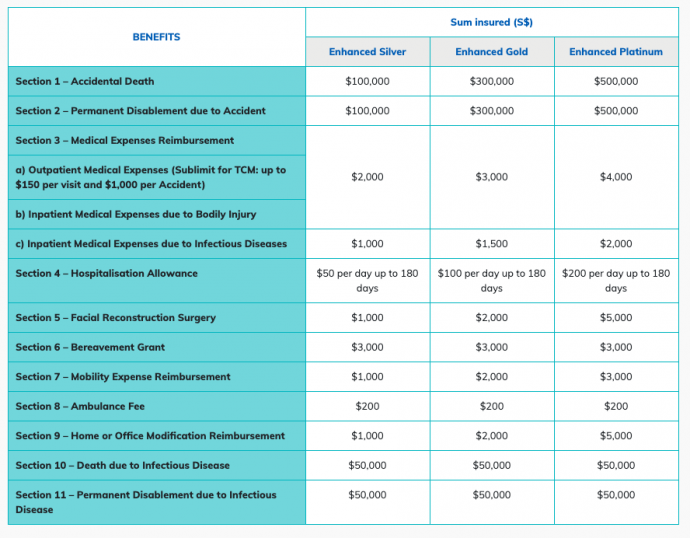

When I got Dengue in early June, fortunately, I bought the Etiqa eProtect Safety which came with a COVID-19 and DENGUE Cover. I got a lump sum of S$3,000 for the diagnosis of Dengue which helped defray outpatient and hospitalisation costs.

It was a harrowing experience because my platelet count dropped to 12k and had to be hospitalised because doctors were worried about internal haemorrhaging. And drinking copious amounts of papaya leaves wasn’t a pleasant experience either. After I got well, I figured sharing the insurance element of Dengue coverage would be relevant now with the rise in Dengue cases.

There are four serotypes of Dengue Virus: DENV-1 to DENV-4. You usually get immunity when you recover from one serotype but you are still not immune to the other serotypes. This means that you can be infected with dengue up to four times.

Symptoms of Dengue fever include fever for 2 to 7 days, severe headache, joint and muscle pain, skin rashes, nausea and vomiting and mild bleeding from nose or gums or easy bruising of the skin. Check out AIA’s education article on the gravity of dengue fever and the ways you can boost your defence from infection.

The Kontinentalist has published a piece The curious case of dengue in Singapore: Why have clusters surged in 2020? on 23 July 2020. An interesting read.

The cases of Dengue in Singapore has recently exceeded 14,000 as at 29 June 2020, with increasing incidences of mosquito breeding found at common areas of residential estates, premises and homes.

The incidence of Aedes mosquito larvae detected in homes and common corridors at residential areas during the two-month Circuit Breaker period showed a five-fold increase compared to in the two months prior.

| No. of offence(s) committed | Enhanced penalties |

| 1st offence | · S$200 for single mosquito breeding detected; or · $300 for multiple mosquito breeding detected within the same inspection; or mosquito breeding detected after legal notice has been served. |

| 2nd offence | · $300 for single mosquito breeding detected; or · S$400 for multiple mosquito breeding detected within the same inspection; or mosquito breeding detected after legal notice has been served. |

| 3rd and subsequent offences | · Prosecution in Court, where the offender may face a fine of up to S$5,000, or imprisonment for a term not exceeding 3 months, or both, for the first court conviction. |

From 15 July 2020, the National Environment Agency will impose heavier penalties than the current composition sum of S$200 for repeated mosquito breeding offences, multiple mosquito breeding habitats detected during a single inspection and mosquito breeding detected after having received a legal notice from NEA. Repeat offenders will also be given heftier penalties or sent to court.

Your Integrated Shield plans, as well as other hospitalisation plans, well cover hospitalisation due to dengue fever, subject to the deductible and co-payment unless you also paid for the Integrated Shield rider.

With the increase in Dengue cases in Singapore, adding on to the burden on medical services from the COVID-19 pandemic, insurers here have upped their support for consumers with added coverage and new insurance plans to address this. But not all Dengue patients get hospitalised.

We spoke with some of the Insurers here in Singapore to find out what type coverage is available for Dengue and COVID-19 as well as new coverage available at this point in time. Those that cover you for outpatient treatment and hospital stays come in particularly handy,

eTiQa ePROTECT safety

Etiqa’s ePROTECT Safety was my lifesaver. Premiums for the Personal Accident insurance plan start from S$18 per month and this personal accident has a complimentary coverage with a lump sum payout of S$3000 per disease should you be diagnosed by a medical practitioner in Singapore with COVID-19 and Dengue for a limited time. Should you be diagnosed with both COVID-19 and dengue fever with the same period of insurance, you will get a lump sum payment of S$6,000. But let’s just hope that doesn’t happen.

From 1 to 31 July 2020, eTiQa is offering free cover for up to 3 children.

Upon renewal of this Policy, any subsequent claim for the diagnosis benefit of COVID-19 and/or Dengue Fever will be subject to a 14-day waiting period.

The personal accident coverage also features round the clock worldwide coverage with protection for death and permanent disability due to accidents or infectious diseases up to S$500,000, outpatient medical expenses up to S$4,000, hospitalisation expenses for 22 infectious diseases including hand, foot and mouth disease, dengue fever and H1N1. So if you are hospitalised for Dengue, you can also claim up to the limit of the plan you picked.

Premiums start from S$18 for Enhanced Silver, S$33 for Enhanced Gold and S$57 for Enhanced Platinum. You get a discount off the premium with my referral code.

AIA

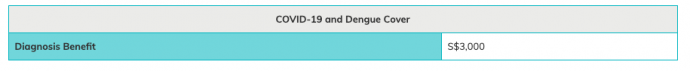

Dengue Hemorrhagic Fever is covered under the Special Condition Benefit of some of AIA’s Critical Illness plans and riders. Complications of Dengue Fever may be admissible for a Critical Illness Benefit claim or premium waiver. If the critical illness plan has Death Benefit, death to Dengue Fever is covered. And if you are hospitalised, AIA’s HealthShield Gold Max, Max Vital Health/Max Essential, Platinum Health, Hospital Income and Hospital Income Special covers hospitalisation due to Dengue Fever. Dengue Fever is covered for accidents or injuries caused by an animal or insect bite for AIA Personal Accident Plans such as Solitaire Personal Accident, Platinum Accident Care and Star Protector Plus.

AIA has offered 2.6 million eligible individual customers, corporate members, employees and AIA representatives free COVID-19 coverage including death payout of S$25,000 and S$1,000 fixed sum for diagnosis of COVID-19 and admission to hospital. This free benefit is offered till 31 December 2020 or 30 days after the Disease Outbreak Response System Condition level has gone down to green, whichever is earlier.

AIA has covered the cost of 50,000 video medical consultations by WhiteCoat, AIA’s on-demand telemedicine partner since 1 March 2020 for MediSave-approved AIA HealthShield Gold Max customers.

Aviva

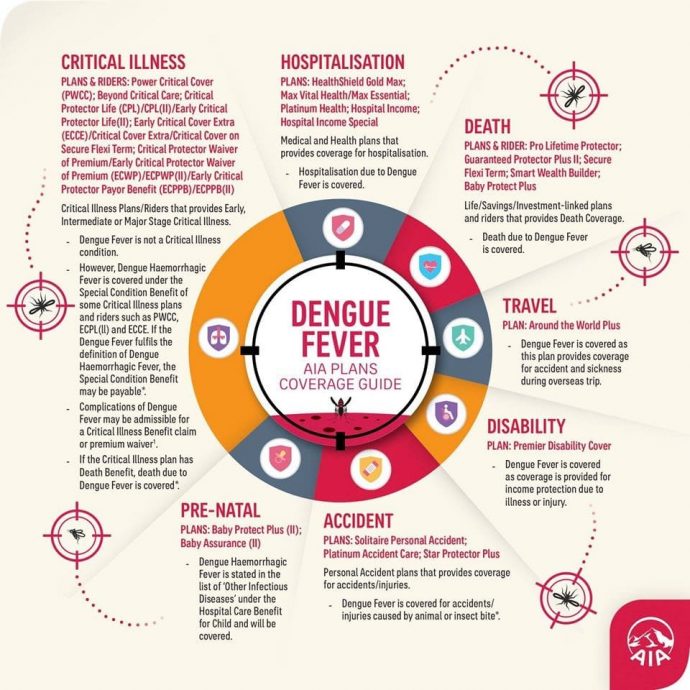

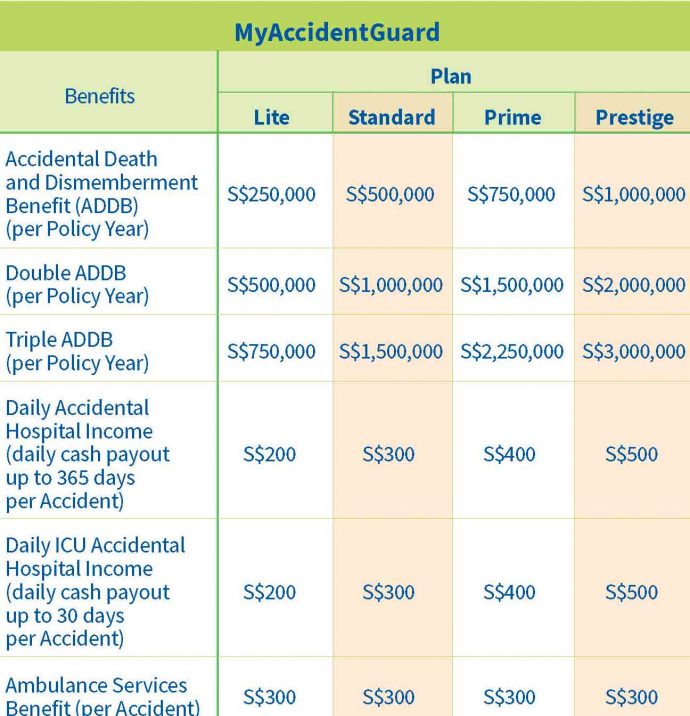

Aviva hasn’t introduced any new insurance coverage for dengue. Its existing Personal Accident and MyAccidentGuard insurance plans cover the illness.

The Personal Accident plan covers illness or injury caused by animal bites including Dengue or Zika under medical expenses up to S$5,000 depending on the whether you are insured under the Lite, Standard or Plus plan.

MyAccidentGuard insurance plan covers insect and animal bites, and infectious diseases such as Hand, Foot and Mouth Disease, dengue fever or zika virus. Coverage of up to S$3,000,000 may be provided depending on the type of plan that you have chosen, i.e., Lite, Standard, Prime or Prestige. There are also options for additional riders.

AXA

AXA offers non-hospitalisation and hospitalisation medical expenses due to dengue coverage with its AXA SmartPA Protect+ personal accident plan with coverage ranging from S$2,000 to S$10,000 with the insured amount doubled for hospitalisation over 48 hours.

From 1 February to 30 September 2020, AXA offers complimentary COVID-19 coverage of S$200 hospitalisation income per day up to 90 days and S$20,000 Death Benefit to policyholders and insured persons with an in-force Life, Shield, individual Health, Lifestyle (Travel, Personal Accident, Home & Domestic Helper) or Motor Policy. This coverage is valid until DORSCON level has officially stepped down to green, or when AXA’s COVID-19 Care Package fund of S$500,000 has been fully utilised whichever is earlier.

FWD Insurance

FWD Insurance is offering COVID-19 insurance coverage for 100 days at a one-time payment of S$28. Critical Frontliners get double the coverage with a total of S$100,000 death benefit due to COVID-19.

The COVID-19 insurance covers daily cash allowance of S$100 for up to 14 days when hospitalised in ICU, a lump sum cash benefit of S$800 for post-hospitalisation and S$50,000 death benefit due to COVID-19. Do note that there is a waiting period of 14 days from the day you bought this insurance which does not pay any benefits.

You can also get a FWD Personal Accident & Infectious Disease Insurance, an exclusive SingSaver coverage, that covers medical expenses from infectious diseases including COVID-19, dengue, Zika virus and more bundled with a personal accident policy. Available at S$98 per annum for individual cover, S$186.20 for couples cover and S$252 for family cover.

Financial Protection provided in event of a confirmed Infectious Disease (including COVID-19, Dengue etc)

| Covers a wide range of Infectious Diseases: Anthrax; Avian Influenza or “Bird Flu”; Chikungunya fever; Dengue fever; Ebola; Hand, foot and mouth disease; Japanese viral encephalitis; Legionnaires’ disease; Malaria; Measles; Melioidosis or “Soil Disease”; Middle east respiratory syndrome; Mumps; Nipah viral encephalitis; Novel Coronavirus or “COVID-19”; Plague; Rabies; Rubella; Severe acute respiratory syndrome; Tuberculosis; “Mad Cow Disease”; Yellow fever; Zika virus; Cholera | N/A |

| Death Benefits | $50,000 |

| Permanent Total & Partial Disability (per policy year) | $50,000 |

| Guardian Angel Benefit (per policy year) | $50,000 |

| Funeral Grant (Death) | $2,500 |

| Infectious Diseases Medical Expenses SG (Inpatient/ Outpatient) | $1,000 |

| Infectious Diseases Medical Expenses Overseas (Inpatient/ Outpatient) | $2,000 |

| Infectious Diseases Hospital Cash Coverage (Allowance) | $25/ day (up to 365 days) |

Additional benefits for any accident (Personal Accident policy)

| Sum Assured | $100,000 |

| Emergency Medical Evacuation | Unlimited |

| Accidental Death Benefits | $100,000 |

| Permanent total & partial disability | $100,000 |

| Medical Expenses SG (Inpatient/ Outpatient) | $2,000 |

| Medical Expenses Overseas (Inpatient/ Outpatient) | $4,000 |

| Hospital Cash Income | $50/ day |

| Hospital Cash Income – Intensive Care | $100/ day |

| Ambulance Fees | $500 |

| Chinese physician, acupuncturist, bonesetter and chiropractor expenses | $500 |

| Daily taxi allowance (up to 2 weeks) | $20 |

| 24 hours medical helpline | Service |

| Emergency phone charges (Overseas) | $300 |

| Guardian angel benefit | $100,000 |

GoBear Work From Home Care

GoBear has launched a first of its kind – Work From Home Care insurance that is underwritten by Chubb offering protection against risks faced while telecommuting during the COVID-19 outbreak.

Available for individuals, couples, and families on a monthly subscription basis, Work From Home Care offers the following:

- Doctor Anywhere Subscription: Video-consult a Singapore-registered general practitioner on-demand anytime, anywhere through Doctor Anywhere app, with free medication delivery in less than 3 hours.

- Worldwide Personal Accident Benefit: Coverage includes reimbursement of accidental medical expenses, accidental permanent disablement and accidental death.

- Identify Theft Benefit: Covers legal expenses and loss of income in the face of increased cybersecurity risks with office and school activities being conducted from home.

- COVID-19 Hospital Cash Benefit: Daily cash pay-out for COVID-19 hospitalisation and lump sum payment if the individual is subsequently admitted to ICU, up to 30 days from policy commencement. Limited offer – only for policies acquired from now till 15 July 2020.

Monthly premiums are priced at S$24.99 for individual, S$44.99 for individual and partner and S$59.99 for individual and family.

Great Eastern

Great Eastern’s Great Value Protect personal accident plan extends coverage of selected infectious diseases that includes Dengue and COVID-19. This group policy can be purchased since February and March 2020 from Great Eastern’s existing digital affinity partners which include Qoo10, Shopee and caregiverasia.com. The annual premium is S$19.06. Coverage includes hospital cash of S$100 per day for up to 14 days, S$20,000 payout for accidental death and disability, S$10,000 payout for death due to COVID-19.

Great Eastern has a suite of products with increased coverage benefits, periods and amounts for Dengue to suit your needs.

- Essential Protector Plus (Hospitalisation Income),

- Great Protector Active (medical expense reimbursement),

- GREAT Junior Protector (medical expense reimbursement),

- GREAT Golden Protector(medical expense reimbursement),

- Great SupremeHealth (hospitalisation and related expense reimbursement) and

- Great TotalCare (hospitalisation and related expense reimbursement).

Complimentary Dengue Insurance coverage with a doctor video-consult session from Doctor Anywhere has been offered for free since May when you register for the Great Eastern Assurance Kit. This covers you for a term of 180 days and provides you with a daily hospital cash benefit of up to S$150 per day ( up to a maximum of 10 days) if you are hospitalised for mosquito-borne diseases such as Dengue, Zika and more. This complimentary promotion is available to Singaporeans, PR or foreigners 18 years and older residing in Singapore with a valid Singapore mailing address and employment pass or work permit.

In February 2020, Great Eastern launched a S$1 million COVID-19 Customer Care Fund to help Great Eastern customers based in Singapore (or their immediate family members) if they were to be hospitalised due to COVID-19, with a cash benefit of S$200 per day up to 60 days and S$20,000 in the unfortunate event of death.

Manulife

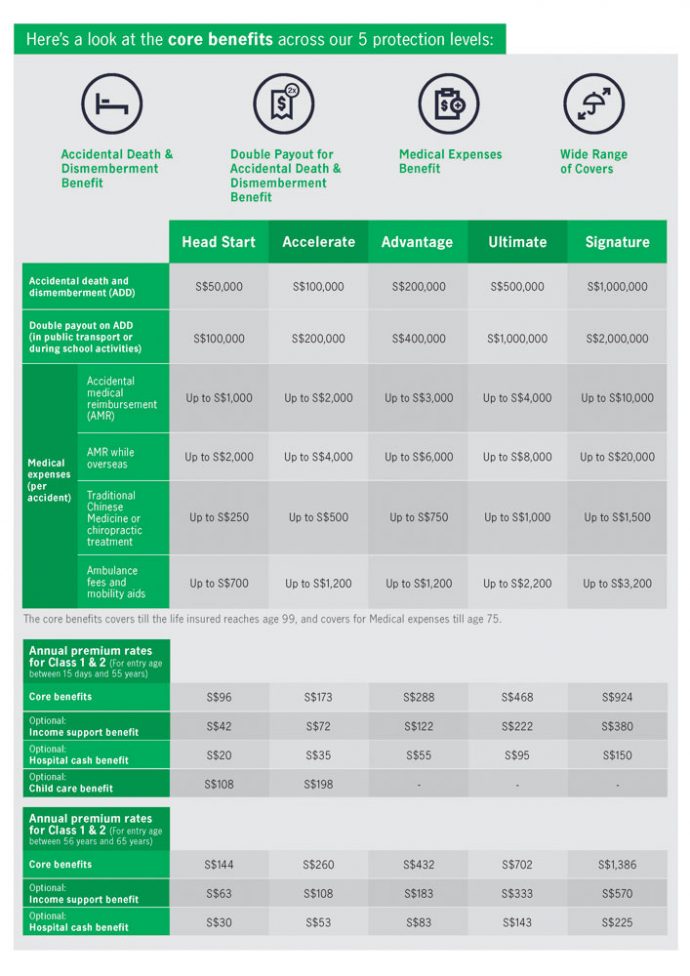

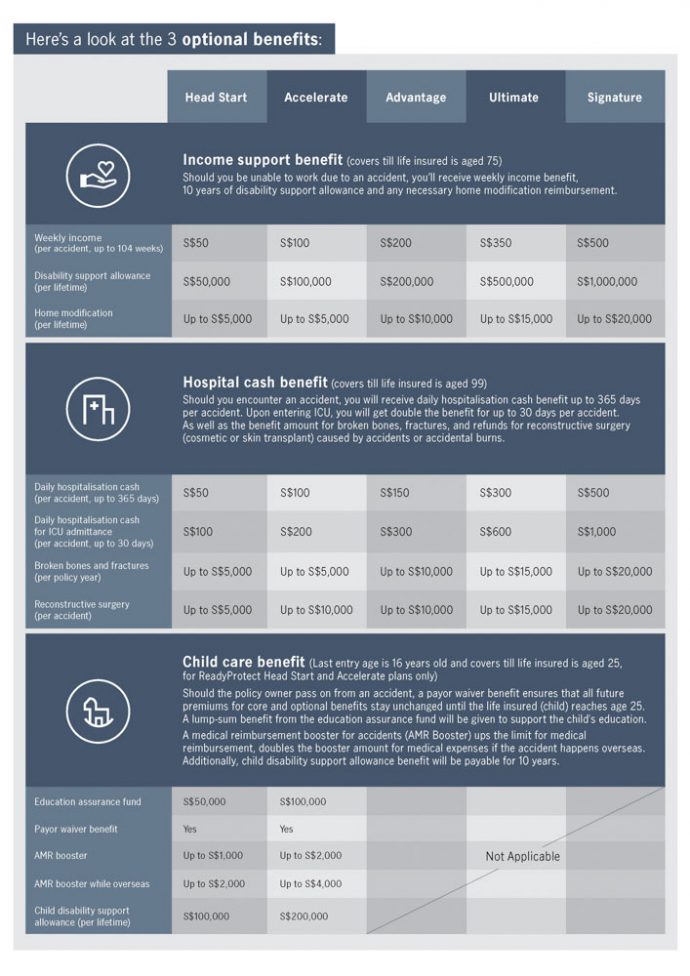

Manulife ReadyProtect is a 24-hour worldwide personal accident plan covers 21 infectious diseases including Dengue as well as insect and animal bites or food poisoning. Mosquito-borne infectious diseases covered include Dengue fever and Dengue haemorrhagic fever, Chikungunya fever, Japanese viral encephalitis, Malaria, Yellow fever and Zika virus.

It provides lump sum accidental death, dismemberment benefits and a double payout in the event of an accident in public transport or during school activities. It reimburses against medical expenses, traditional Chinese medicine, chiropractic treatment, ambulance fee and mobility aids as a result of an accident. Do note that there is a 30 day waiting period from the policy start date.

MSIG

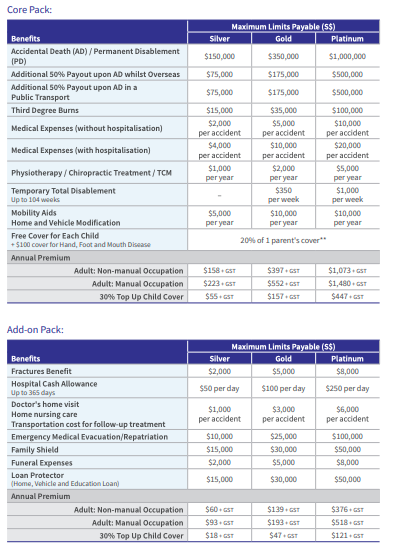

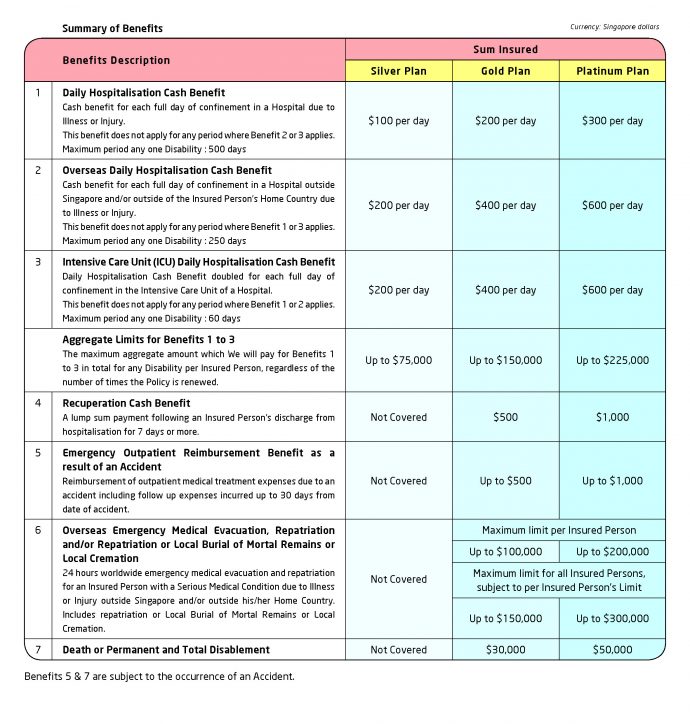

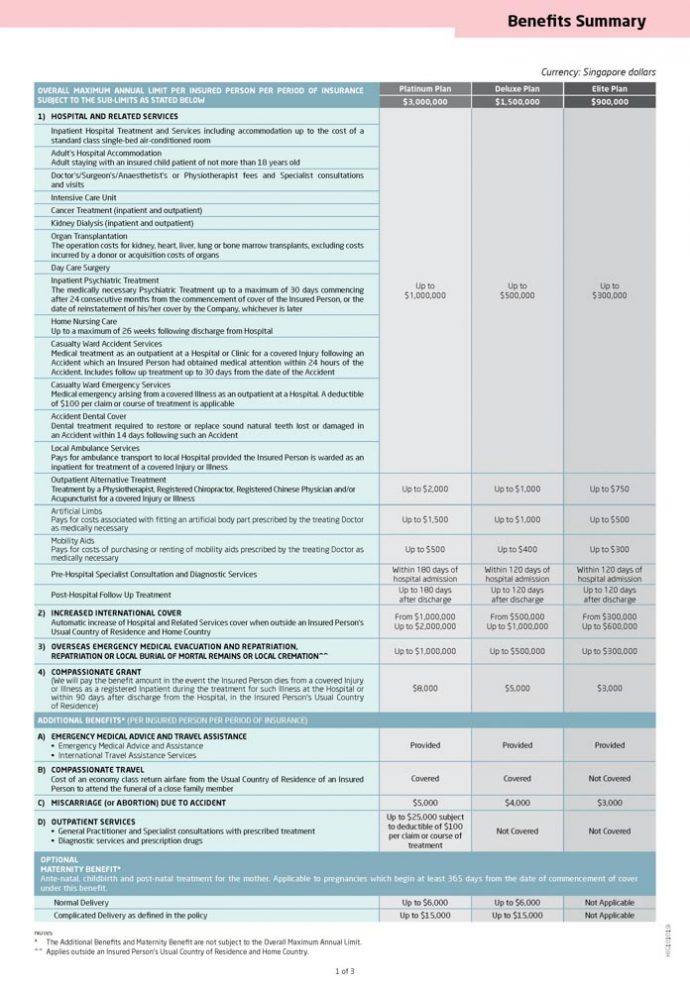

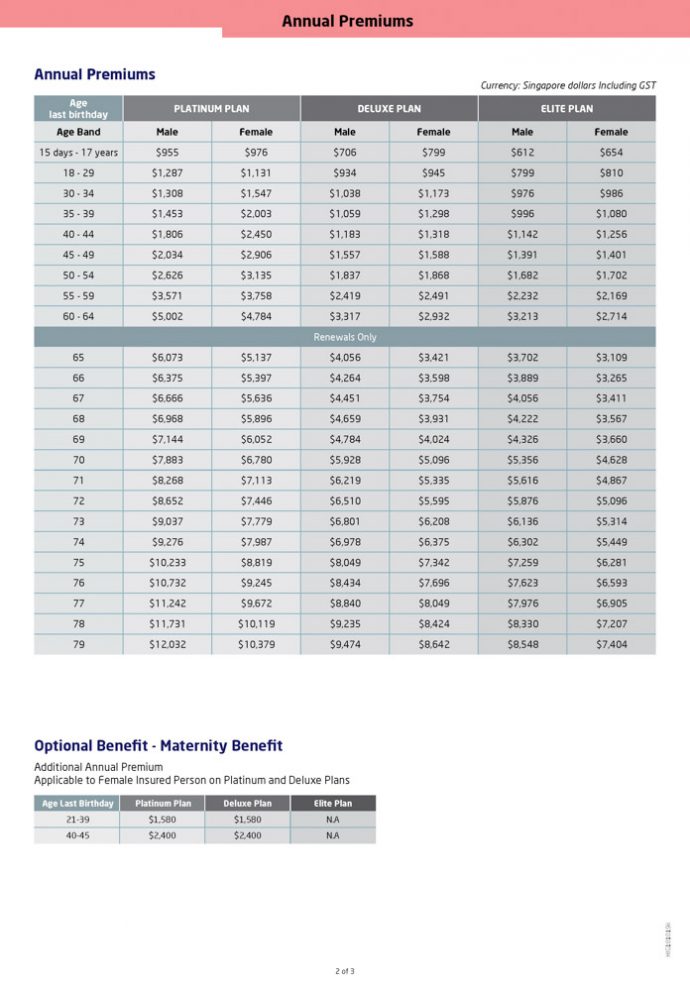

MSIG’s health plans offer cover for Dengue and COVID-19.

Hospital CashPlus pays out a daily benefit of up to S$300 for 500 days or S$150,000 for any one illness when hospitalised in Singapore. The daily benefit is doubled to S$600 for overseas hospitalisation for up to 250 days. A daily double benefit of S$600 is offered for hospitalisation in ICU for up to 60 days. Other benefits include a S$1,000 recuperation cash payout upon discharge from a hospital stay of at least 7 days and S$1,000 reimbursement for emergency outpatient medical treatment expenses following an accident.

MSIG Prestige Healthcare covers your inpatient and outpatient treatments of up to S$3 million depending on which of the three plans you pick. Coverage is doubled when you are hospitalised overseas. Hospitalisation expenses are settled directly by MSIG so you enjoy a cashless service.

NTUC Income

NTUC Income has coverage for Dengue fever and COVID-19. Income’s Personal Accident Assurance plan provides coverage for various types of professions as well as optional protection against 21 infectious diseases including Dengue Fever. Annual premiums range from S$217 to S$2,185 depending on your profession. Coverage includes the reimbursement of medical expenses of up to S$20,000 for infectious disease as well as a payout of up to S$500,000 for permanent disability or death due to the infectious disease.

COVID-19 cover has been extended to Personal Accident plans with infectious disease covers as well as Group Employee Benefits policies at no additional premium since 17 February 2020.

Income has also extended COVID-19 benefits to Income Family Micro-Insurance Scheme which offers insurance protection at no premium to almost 29,000 eligible individuals who are parents or guardians of a child or ward studying in a local primary school and a recipient of the Ministry of Education’s Financial Assistance Scheme. IFMIS offers a pay-out of S$5,000 if the insured person were to pass away or suffer a total and permanent disability, and this scheme now includes COVID-19 benefits until 31 August 2020. The insured person also gets a cash pay-out of S$200 per day of hospitalisation in Singapore due to COVID-19 for up to 30 days.

For more details on Income’s COVID-19 benefits, please refer to https://www.income.com.sg/our-covid-19-coverage.

Prudential

Employees of FinTechs registered on the API Exchange platform, as part of our partnership with the ASEAN Financial Innovation Network (AFIN) will get S$20,000 complimentary coverage against accidental death and injury which increases to S$50,000 if an employee is retrenched. Other benefits include a one-time hospital income payout of S$500 if hospitalised for dengue haemorrhagic fever and PRUcare package which comes with a one-time cash benefit of S$500 when served with a quarantine order and daily hospitalisation allowance of S$200 for three months if hospitalised for COVID-19.

Prudential recently launched Pulse, an artificial intelligence powered mobile app to provide all Singapore residents with round the clock access to healthcare services and real-time health information. Check symptoms, conduct digital health assessment to better understand future risks and seek timely health advice anytime and from anywhere. Consult a doctor via video consultation for a flat fee of S$15.

Prudential customers who download and register their profiles on Pulse enjoy a one-month extension of the S$200 daily hospitalisation allowance (for up to 3 months of hospitalisation) from 1 July to 31 July 2020. Non-Prudential customers who downloaded and registered their profiles on Pulse enjoyed a S$100 daily allowance (for up to 3 months of hospitalisation) between the date of app (Pulse) registration and 31 May 2020.

- The key features of Pulse are:

- AI-powered Symptom Checker* – The AI-powered chatbot provides users with insights into possible health conditions based on the symptoms experienced. At the end of the chatbot conversation, users are guided to an appropriate triage outcome (e.g. ‘Self Care’, ‘Pharmacy’, ’GP’, ‘GP urgent’, ‘Hospital’ or ‘Hospital urgent’) and provided further information about possible causes where available. This tool has been recently updated to provide alerts on specific symptoms and conditions that could be related to COVID-19. Users are also advised to follow the recommendations provided by local health authorities as the COVID-19 situation can evolve rapidly.

- AI-driven Healthcheck* – This is a lifestyle assessment and disease risk prediction tool. By doing a 15-minute digital questionnaire, users can get a report in real-time on their overall health status and long-term disease risks based on their lifestyle habits, medical history, family’s medical history, diet and mental health. The report is presented through a “Digital Twin” and includes health advice to help one reduce disease risks and improve overall well-being.

- Video Consultation with a Doctor – Users can schedule a video consultation with a GP at any time of the day. The GPs are available 24/7 and will diagnose and advise on the appropriate treatment(s), whenever applicable. Users can opt for delivery of their prescribed medicine or collect it at a local Guardian pharmacy.

* Symptom Checker and Healthcheck are not intended for detection or diagnosis of diseases. In addition, both Symptom Checker and Healthcheck are not suitable for pregnant women, children under the age of 18 years, and users with long-term medical conditions or disabilities who may have different needs and risks. Symptom Checker should never be used in a medical emergency, and users should contact their local emergency services instead.

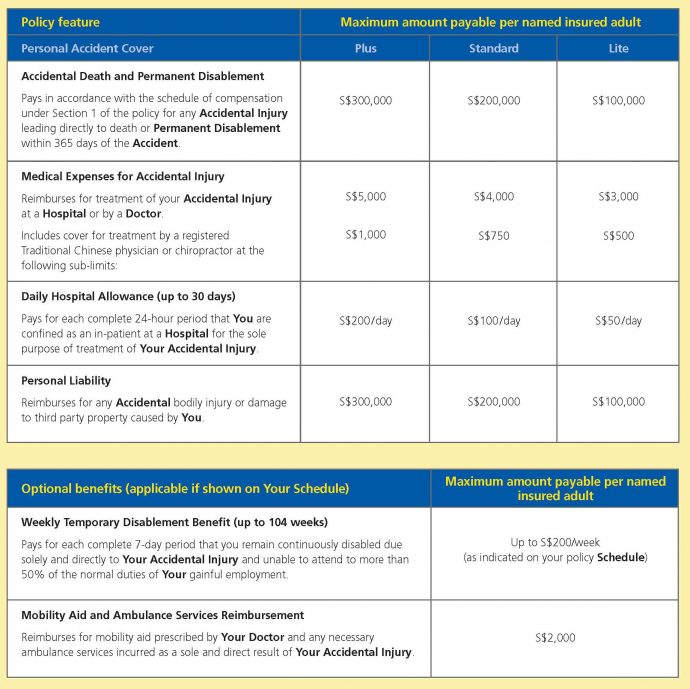

Sompo Singapore

Sompo Singapore is offering up to S$100 GrabFood e-vouchers for signups by 31 July 2020 of its PAStar policy which covers dengue and 16 other infectious diseases. PAStar covers Accidental Death and Permanent Disability, Hospitalisation or Outpatient medical expenses due to accident or infectious diseases, a daily hospital allowance due to accident for up to 365 days, weekly income benefit for temporary disablement for up to 104 weeks and mobility aid purchase or rental.

There are three main plans to pick from and options to increase the coverage for Accidental Death and Permanent Disability as well as Parent cover for up to S$25,000 upon accidental death or permanent disability.

And if you are looking for home insurance coverage, Sompo’s HomeBliss offers home disinfecting services coverage in the event of infectious disease outbreak including Dengue Fever, HFMD, Zika and more, as well as the other usual home insurance coverage. Other highlights of HomeBliss include protection against smoke damage from cooking unit, expenses for tracing and assessing of water seepage, 24-hour home emergency assistance service with reimbursement for selected service, mobility enhancement expenses to modify your home if you or your family members suffer permanent disability, as well as worldwide family personal liability that is extended to cover Property Owner’s liability and Tenant’s liability.

Tokio Marine

Tokio Marine offers coverage for infectious diseases originating from mosquito bites calling it TM Protect MosBite. The renewable annual personal accident plan offers 100% lump sum benefit payout to you and your family upon diagnosis of Dengue fever, Zika fever, Chikungunya fever, Yellow fever and Malaria. It complements your other medical plans.

| Plan A | Plan B | |

|---|---|---|

| Basic Benefit | S$3,000 | S$1,500 |

| Annual Premium (With GST) | S$59 | S$39 |

There are only two plans to choose from with benefit payout of S$3,000 or S$1,500 with annual premiums of S$59 and S$39 respectively.

Do note that there is a 14 day waiting period from the issue date of the policy. This means that you are not covered for the first 14 days of your insurance cover. There is also a 90 day separation period meaning that you would not be able to claim from the day you first contracted a covered disease till the next time you get diagnosed with a covered disease.

Pingback: How to Shed Access Weight & Stay Fit »

Pingback: Prudential Launches PRUSafe Dengue plan & Improved Pulse Mobile App »

Pingback: Singaporeans Realised They Have Taken Their Health for Granted - AIA Poll »